Bitcoin’s longest maturity expires on the 26th. March. More than $6 billion in bitcoin (BTC) options expire Friday on all exchanges, with most of those options on deribits. This will be a record low in terms of value and number of options, with only 100,400 bitcoin options. The previous record was set in January, when nearly $4 billion worth of options expired, representing 36% of open interest at the time.

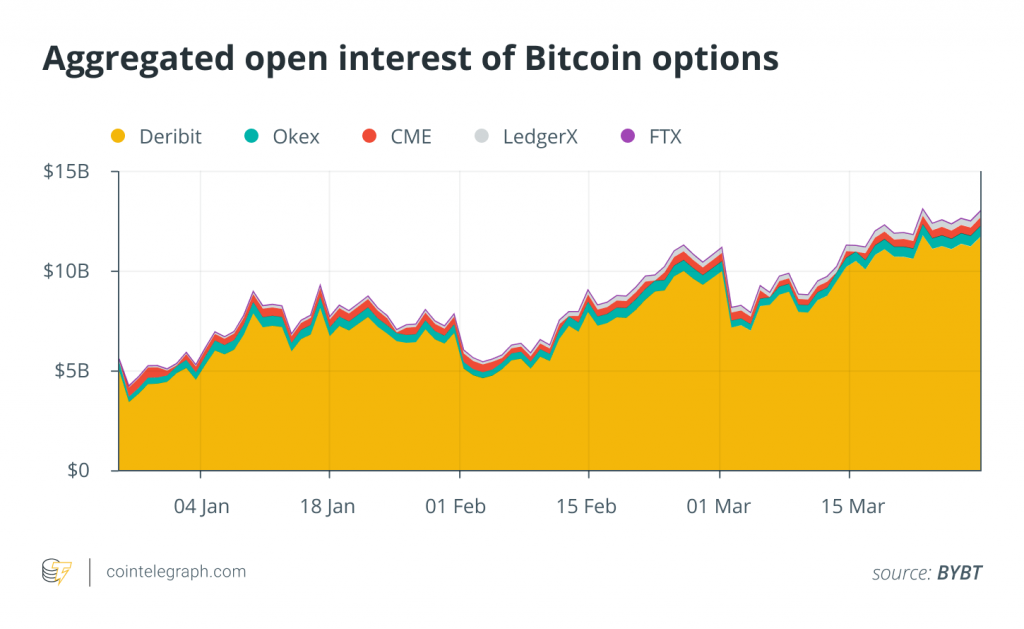

The sharp drop in options comes amid a rapid increase in open interest in the bitcoin options market. Bitcoin’s IO has increased by more than 147% since the beginning of the year. Total IO on the five largest crypto-derivatives exchanges now stands at $14.01 billion, up from $5.67 billion in Q1. January.

The influence of the options market on the cash market is increasing

The size of the options market is increasing, both in volume and in open interest. As a result, the influence of this market on the cash markets is also increasing. It is well known that the futures market is an important tool for price formation in the spot market. In the traditional financial markets, for example, the size of the futures market is several times larger than the size of the spot markets for assets such as gold, stocks, etc.

In the case of bitcoin, however, the opposite is true: The BTC cash market is many times larger than the derivatives market. Nevertheless, investors look to the futures markets to gauge prices at various stages and to the options market to gauge prevailing sentiment. Sam Bankman-Fried, CEO of FTX, a crypto-currency derivatives exchange, told Cointelegraph:

BTC derivatives have been a key driver of the cash markets for years. At least in 2018, derivatives move the spot more than the spot moves the derivatives.

This shift began in 2018, when options volumes began to rise, attracting more investors looking to hedge their bets on the futures and cash markets. Cointelegraph discussed the impact of options markets with Shaun Fernando, head of risk and product strategy at Deribit, a crypto-currency derivatives exchange. He said:

The influence of field options increases as RO and volume increase. How much more impact can you see, but there can be immediate price shocks when you trade whale options. Options can also be considered one of the many leading indicators in the cash market.

The expiration will not cause all options to trade at the same time, as some strike prices seem very unrealistic. The options market is generally an all-or-nothing game; when they expire, they are either worth something or they are considered completely worthless. They become worthless if the underlying asset trades above the strike price of the call or below the strike price of the put.

Designated call options are contracts that give the holder of the option the right, but not the obligation, to purchase the underlying asset at a predetermined price within a specified period. Put options, on the other hand, are contracts that give the option holder the right, but not the obligation, to sell the underlying asset at a predetermined price on a specific date. This predetermined price is called the base price.

Markets could rise after the deadline

Bitcoin has seen bearish price action over the past week. It went from a $60,000 prize on the 19th. March to trade in the $50,000 range on the 25th. March. The decline has led investors to question the true value of bitcoin and whether the end of the bull market is near.

But the expiration of the $6 billion deadline could change that view. Bankman-Fried went on to explain that options writers are more comfortable selling mistakes than writing on top, he said:

The crypto industry is bullish on crypto (shocking!). This can be seen in a variety of ways, from positive term premiums to perpetual funding rates and USD loan rates; this is another sign.

It is advantageous to exclude bearish neutral puts below $47,000 and calls with strike prices above $66,000 when assessing the impact of expiration, as both of these scenarios seem highly unlikely. That leaves an imbalance of $668 million in favor of rising calls, which could dominate sentiment after expiration.

Analyzing bitcoin’s price history after options expire, Twitter user James Viggiano shared an interesting observation: the price tends to rise after options expire. The same applies to each monthly due date from October 2020 to February.

While the expiration of over $6 billion in options seems huge for bitcoin markets, it is important to note that nearly 43% of those options are worthless due to BTC’s current price range. Therefore, options that expire are actually worth much less than what expires.

Robbie Liu, a market analyst at OKEx Insights – a research group for the cryptocurrency exchange OKEx – told Cointelegraph: Sharp declines in options are often accompanied by a rise in spot volatility, and the same is true for futures.

The maximum price per option expiration date is currently $44,000. The maximum price is the strike price at which there are the most puts and calls. This is the price at which the maximum number of market participants will suffer financial loss. The maximum pain theory states that the option price will tend towards the maximum pain price as the expiration date approaches. Fernando then explained the maximum price of pain for this particular expiration event:

The maximum pain at 44k creates a slight downward pressure force on the point. Once this pressure is removed, the chances of an upward movement are high. Some say it’s no coincidence that we had big moves when the big options declined.

Also important, monthly volatility is currently at its lowest level since 2021 and implied volatility is at its lowest level since December 2020. Lower implied volatility implies lower premiums, making options cheaper for investors.

The greater the total number of OI options for a given asset, the greater the effect on the price of the underlying asset. The maximum price pain at $44,000 creates bearish sentiment in the market – this is a concern for long-term bulls. Liu gave his opinion on what the markets can expect after historical options expire:

After any significant decline, the market may rebound in the short term and since we are in a broader bull market, a price recovery is the most likely outcome at this stage. However, the larger the cryptocurrency market becomes, the more it correlates with different market segments, making it less predictable.

After Tesla began accepting bitcoin from American customers for payment of its products, bitcoin has received more and more services from institutions. This caused another one of Elon’s candles to hit the market, pushing the price up by $3,000, but the situation calmed down the next day. Tesla even publicly removed the hard fork of Bitcoin Cash (BCH), causing the token to hit new lows in the market.

Nevertheless, the expiration of the options could ease the current bearish pressure on the market and bring the markets back up, as the options market indicates that the markets are still in a higher trend.

frequently asked questions

What happens when bitcoin options expire?

The expiry of the deadline could make a possible sale more difficult. Simply put, carry trades would square off: Short-term positions in the futures markets are closed or may expire and long positions in the cash market may be sold, leading to greater price volatility.

What time do bitcoin options expire on Friday?

The last day for bid submission is the last Friday of the contract month. Trading in expiring futures contracts ends at 16:00. London time on the last trading day.

Why has the price of bitcoins dropped so much?

1. Funding Stress. … So there was always the risk of a reset of funding. According to data source Coinalyze, the price drop has so far eliminated more than $300 million in bitcoin longs – about 30 percent of the total $1.33 billion in liquid longs in the crypto market.